QuickBooks On-line is known for integrating with hundreds of third-party apps, from HR and time-tracking apps to payroll. Honestly, it doesn’t sync with much—but most crucially, it does not sync with any of the everyday ecommerce integrations, corresponding to Shopify. In different words, if you’re promoting products rather than providers, we do not advocate QuickBooks Self-Employed.

How Often Do I’ve To Pay Estimated Taxes?

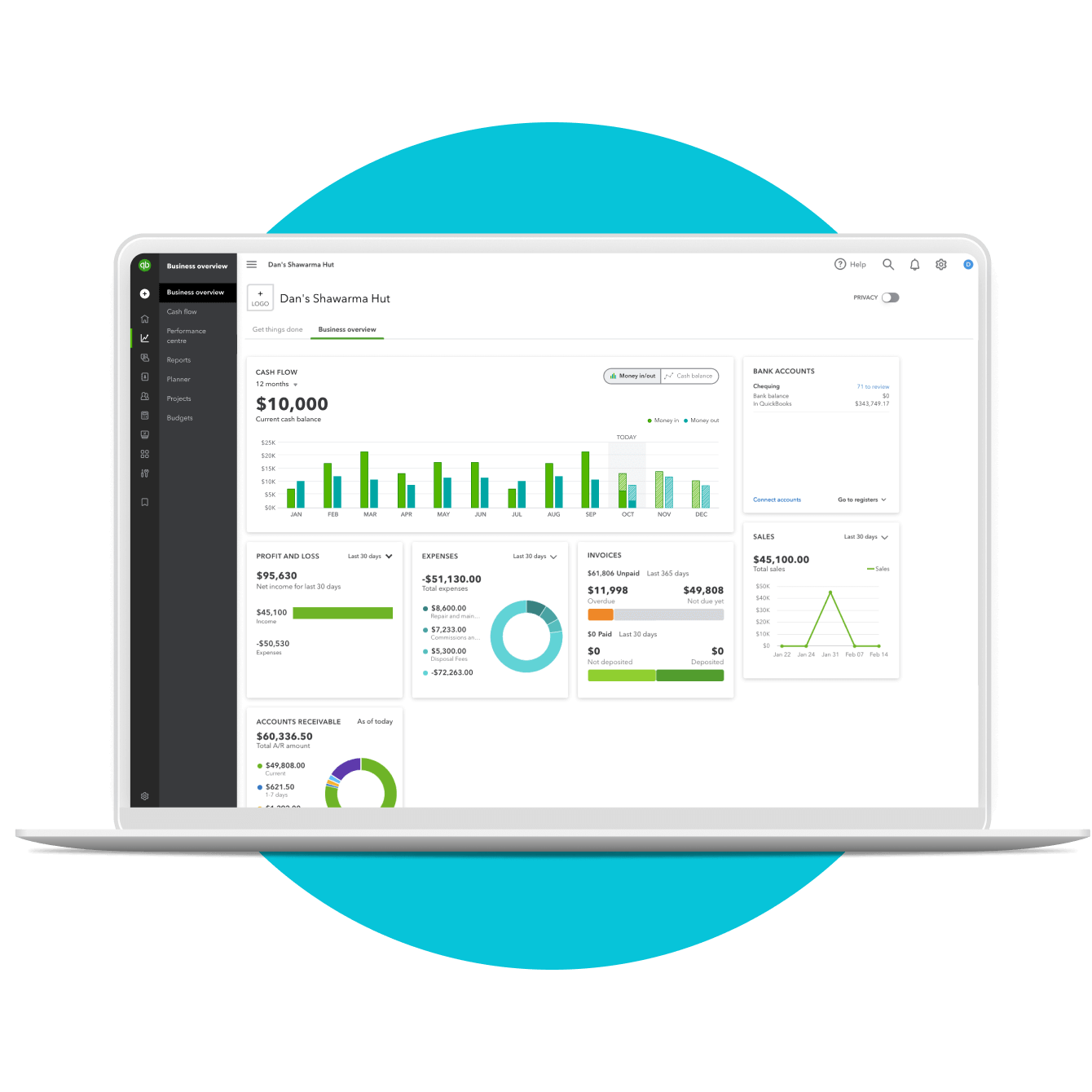

Bookkeeping often refers to the strategy of preserving your monetary data so as, while accounting refers to utilizing that monetary information to make informed business choices. Software Program like QuickBooks Self-Employed can help you retain accurate monetary information, however it doesn’t provide many analytic instruments. In distinction, QuickBooks for small companies includes bookkeeping and accounting options, like profit and loss tracking and administration. These features may help you track primary income, get paid on time, and benefit from your end-of-year tax deductions. For single proprietors, contractors, and impartial contractors in want of an easy and user-friendly accounting software program program, QuickBooks Self-Employed is a incredible selection.

Now that you understand what your tax liabilities seem like as a self-employed particular person, you’re ready to complete the self-employed payroll steps. Self-employed people can deal with payroll by hand, use payroll software, or hire a bookkeeper to do it for them. Self-employed individuals are individuals who personal their very own businesses and work for themselves. You are typically considered self-employed in case you are a sole proprietor, unbiased contractor, or if your business is unincorporated. Payroll administration in QuickBooks supplies an optimized and efficient resolution for organizations of varying scales.

- When they’re canceled, you might have read-only access to your information for one year after the cancellation.

- To be taught extra in regards to the finance hacks you should grow, we’ve obtained you coated.

- Self-employed people must withhold and pay self-employment tax to cowl their liabilities.

- This is a particular adjustment to earnings on your tax return, which is a great tax benefit.

The accounting software product QuickBooks was created and is commercially distributed by Intuit. Catering primarily to small and medium-sized enterprises, it supplies both on-premises and cloud-based accounting purposes. These iterations can course of payroll, manage and pay invoices, and accept quickbooks self employed payroll enterprise payments.

Enterprise and personal expenses are routinely sorted into classes, so you’ll be able to track your spending and maximize tax deductions. With the Elite plan, though, you also get what QuickBooks calls tax penalty safety. With this enhanced safety level, QuickBooks Payroll will cowl as much as $25,000 of IRS fees should you incurred these fees while using QuickBooks Payroll software program. On the opposite hand, should you love QuickBooks Online but aren’t thrilled about QuickBooks Payroll, you’ve dozens of options. Rivals like Gusto, Paychex, OnPay—honestly, most payroll software program solutions—all sync simply with QuickBooks Online.

Cost And Time Effectiveness

Our rigorous editorial process contains enhancing for accuracy, recency, and clarity. QuickBooks Self-Employed is designed to make tax season much less stressful by providing instruments that assist customers keep organized and knowledgeable. Setting up recurring invoices can significantly reduce the trouble of guide invoicing every month.

Key Quickbooks Self-employed Options

Self-employed people should withhold and pay self-employment tax to cover their liabilities. A rudimentary understanding of prevalent payroll errors in QuickBooks can avert processing inaccuracies during payroll transactions. The software program supplies functionalities for monitoring and classifying expenditures, essential for budgeting and tax preparation. This blog explores the intricacies of tips on how to do payroll in QuickBooks, guaranteeing a streamlined and compliant process for organizations of various scales. QuickBooks Payroll helps you create and download detailed reviews to get actionable insights about your freelance business.

Learning tips on how to arrange payroll for self-employed folks might seem daunting. Nevertheless, with the best tools and sources at your disposal, payroll can be a breeze. No matter what business you are working in proper now, paying yourself has by no means been extra simple. If you’ve just joined the ranks of the 56.7 million freelancers within the US right now, you in all probability have a lot on your plate. Past the hectic day-to-day work of securing shoppers, fulfilling orders, and getting your private brand on the market, additionally, you will have to deal with self-employed payroll. If you’re handling payroll by hand, you need to https://www.quickbooks-payroll.org/ calculate your self-employment tax liabilities (discussed earlier).

Now that you’ve discovered about self-employed individuals, it’s time to interrupt down what sort of payroll taxes self-employed individuals need to pay. Read on to discover the ins and outs of self-employed payroll, together with how to calculate self-employed payroll taxes and what steps to follow. Learn how to get set up, pay your group, discover HRsupport and advantages, and sync with accounting soyou can manage everything in a single place. At Business.org, our research is supposed to supply basic product and service recommendations.

Count on our Tax Resolution Team to assist resolve tax points and pay up to $25,000 per 12 months for penalties. Discover assist articles, video tutorials, and join with different businesses in our online group. We will assist you to switch any current payroll information to QuickBooks. To get paid quicker, here are 20 tips designed to get clients to pay their bills by the due date or earlier.

Sole proprietors, including unbiased contractors and partners in a partnership, typically pay self-employment tax if they earn $400 net or more each year. Relying on the circumstances, caregivers who’re paid for providing in-home services to family members who are elderly or have disabilities may should pay self-employment tax. This rule generally solely applies to individuals who, in addition to caring for a family member, personal a business that gives caregiving providers. Terms, conditions, pricing, particular features, and repair and help options are topic to change without discover. That means, along with automated payroll, you’ll receive full-service options.