Unlocking Success: The Forex Trading Business Explained

The forex trading business offers a myriad of opportunities for financial growth. Investors are drawn to this dynamic arena, where the daily turnover surpasses trillions of dollars. Learning the mechanics of forex trading is not just about buying and selling currencies; it involves a profound understanding of various factors, including economic indicators, geopolitical events, and market sentiment. To navigate this challenging landscape, platforms like forex trading business Indian Trading Platforms offer resources and tools that can enhance your trading experience.

Understanding Forex Trading

Forex, or foreign exchange, is the act of exchanging one currency for another in the global marketplace. The forex market operates 24 hours a day, five days a week, and allows traders to profit from fluctuations in currency values. Currency pairs like EUR/USD or GBP/JPY are traded, and the goal is to speculate on whether the value of one currency will rise or fall relative to another.

Why Forex Trading?

Forex trading appeals to both novice and experienced investors due to its high liquidity, accessibility, and potential for significant returns. While it carries risks, the rewards can be considerable. Here are some reasons why individuals choose to engage in the forex market:

- Market Resourcefulness: The forex market is one of the most liquid markets in the world, meaning traders can enter and exit positions easily.

- 24/5 Trading: With the ability to trade 24 hours a day, traders in different time zones can find opportunities that suit their schedules.

- Leverage Opportunities: Many forex brokers offer leverage, allowing traders to control larger positions with smaller amounts of capital.

- Diverse Trading Strategies: From day trading to swing trading, the forex market accommodates a variety of trading styles.

The Role of Economic Indicators

Understanding economic indicators is crucial for successful forex trading. These indicators provide insights into the economic health of a country, which can influence currency values. Some key indicators include:

- Gross Domestic Product (GDP): GDP represents the total value of all goods and services produced in a country over a specific time period. A growing GDP often strengthens a currency.

- Inflation Rates: Central banks use inflation data to set interest rates. Higher inflation can lead to higher interest rates, thus affecting currency values.

- Employment Reports: Employment data, such as non-farm payrolls in the U.S., can impact market sentiment and influence currency movements.

- Interest Rates: Central banks’ monetary policies and interest rate decisions have a direct effect on currency value.

Developing a Trading Strategy

A robust trading strategy is essential for success in forex trading. Here are key components to consider:

- Define Your Goals: What are your financial objectives? Are you looking for short-term gains or steady long-term growth?

- Risk Management: Determine how much of your capital you are willing to risk on each trade. A common rule is to risk no more than 2% of your trading capital.

- Technical Analysis: Utilizing charts and indicators can help identify trends and potential entry and exit points.

- Fundamental Analysis: Keep an eye on economic news and data releases that can impact currency pairs you are trading.

- Maintaining Discipline: Stick to your trading plan and avoid emotional decisions that can lead to losses.

Choosing a Forex Broker

Selecting a reliable forex broker is critical to your trading success. Consider the following factors when making your choice:

- Regulation: Ensure that your broker is regulated by a reputable authority. This adds a layer of security to your trading account.

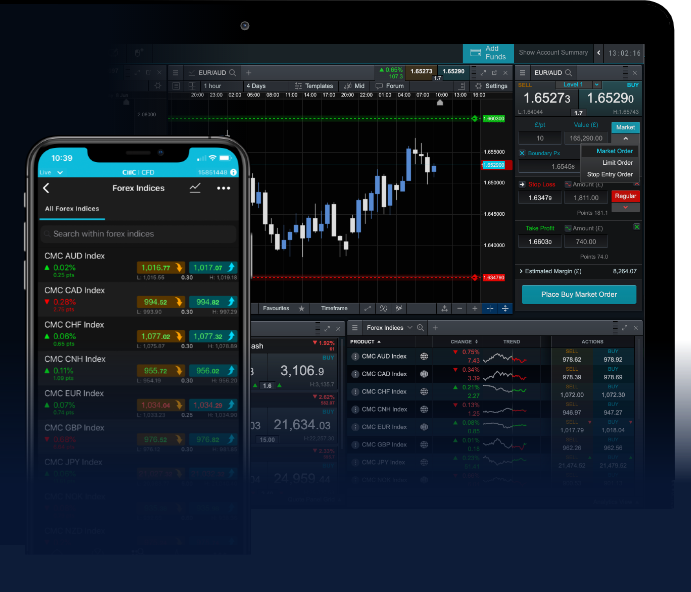

- Trading Platform: The trading platform should be user-friendly and equipped with the necessary tools for analysis and order execution.

- Spreads and Fees: Compare the spreads and fees charged by different brokers. Look for a broker with competitive pricing.

- Customer Support: A good broker should provide excellent customer service to assist you with any issues or queries.

Psychology of Trading

The psychological aspect of trading cannot be overlooked. Successful traders exhibit traits such as patience, discipline, and emotional control. It is important to keep a clear mind, especially during volatile market conditions. Here are a few tips to develop a strong trading psychology:

- Avoid Overtrading: Do not let greed push you into making trades that do not align with your strategy.

- Keep a Trading Journal: Documenting your trades can help you identify patterns, mistakes, and areas for improvement.

- Stay Educated: The forex market is constantly evolving, so continuous learning is imperative.

Conclusion

Entering the forex trading business can be both rewarding and challenging. With the right knowledge, strategy, and mindset, traders can navigate the complexities of the forex market successfully. Whether you are trading currencies for personal investment or aiming for a full-time career, the key is to stay informed and maintain a disciplined approach. By utilizing platforms like Indian Trading Platforms, you can gain crucial insights and support that can guide your journey through this exciting financial landscape.